Brett Rickaby's Insightful Corner

Exploring the world through news, tips, and intriguing stories.

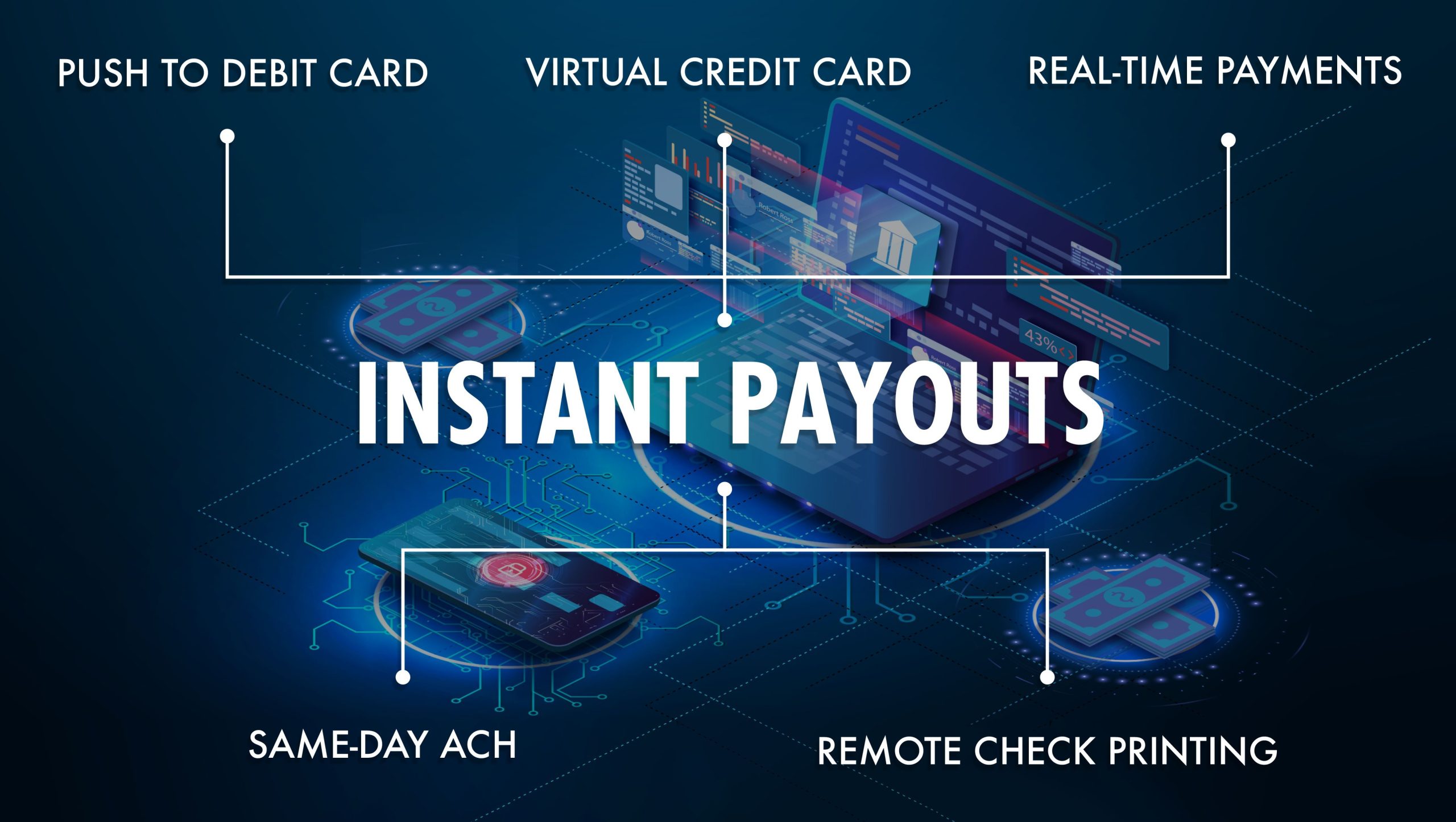

Cash in a Flash: Exploring Instant Payout Systems

Discover the fastest ways to get paid! Unlock the secrets of instant payout systems and cash in a flash today!

Understanding Instant Payout Systems: How They Work and Their Benefits

Understanding Instant Payout Systems is crucial for anyone looking to streamline their financial transactions. These systems facilitate quick and seamless transfer of funds, allowing users to receive their earnings in real-time. The core functionality revolves around advanced payment processing technologies that can handle transactions almost instantaneously. Unlike traditional payout methods that can take days to process, instant payout systems leverage various payment gateways and mobile wallets, ensuring that money is available to the user immediately after a transaction. This reliability and speed can significantly enhance user satisfaction and trust in a service or platform.

One of the key benefits of instant payout systems is their ability to improve cash flow management for businesses and individuals alike. For businesses, it means less lag time in accessing funds, which can be pivotal for operational expenses and investment opportunities. On the user side, this leads to enhanced financial flexibility, allowing consumers to manage their budgets more effectively. Additionally, instant payout systems often come with lower transaction fees compared to traditional banking methods, making them a cost-effective solution for financial transactions. Embracing this technology not only boosts efficiency but also aligns with the growing demand for faster, more convenient financial services.

Counter-Strike is a highly popular tactical first-person shooter that has captivated gamers around the world. Its unique gameplay mechanics and competitive nature have made it a staple in the esports community. If you're looking for ways to enhance your gaming experience, consider using a clash promo code for various in-game benefits.

Top Instant Payout Solutions for Businesses in 2023

In today's fast-paced business environment, having access to instant payout solutions is essential for maintaining cash flow and enhancing customer satisfaction. As we head into 2023, several innovative platforms have emerged, offering businesses a range of options to facilitate quick and efficient payments. Key players such as PayPal Business, Square, and Stripe have expanded their services to meet the growing demand for instant payouts, allowing companies to process transactions in real-time. Each of these solutions provides unique features that can cater to various business needs, from freelancers to large corporations.

When choosing the best instant payout solutions for your business in 2023, it’s crucial to consider factors such as transaction fees, ease of integration, and customer support. For instance, PayPal Business is known for its user-friendly interface and widespread acceptance, while Square offers an all-in-one payment processing solution that includes point-of-sale systems. Additionally, startups and small businesses might find QuickBooks Payments beneficial, as it integrates smoothly with their accounting software, helping streamline both payments and financial tracking. By evaluating these options, businesses can make informed decisions that align with their operational needs and enhance their payment experiences.

Is Instant Payment Right for You? Pros and Cons Explored

When considering whether instant payment is right for you, it’s essential to weigh the benefits against potential drawbacks. One significant pro of instant payment is the speed and convenience it offers; transactions are processed within seconds, allowing you to access your funds quickly. This is especially advantageous for businesses that require immediate cash flow or individuals facing urgent expenses. Additionally, instant payment systems often enhance security features, providing a safer way to exchange money compared to traditional methods.

However, it's crucial to acknowledge the cons associated with instant payment. For instance, fees can be higher when using these services, which may impact your overall finances if you make frequent transactions. Furthermore, while instant payments are convenient, they can also lead to impulsive spending, as funds are readily accessible. It’s essential to evaluate your financial habits and determine if the speed of instant payments aligns with your financial goals. Consider if the advantages outweigh the potential risks before making a decision.